Earning Money

Once you have a job in Canada, your employer pays your ‘net’ or ‘take-home’ earnings. This is the amount that you keep after your employer has taken the deductions from your ‘full’ or ‘gross’ earnings.

Once you retire, CPP might not provide enough money for you to live comfortably. If you can afford it, it is a good idea to save for your retirement by investing in Registered Retirement Savings Plans (RRSPs).

Paycheque Deductions

Employers have to deduct three mandatory employment-related costs (MERCs) off your earnings. They are:

Income Tax

Income tax is a tax levied on your earnings. It helps finance many government programs and services offered to Canadians on federal and provincial levels.

Canada Pension Plan (CPP)

CPP is the money saved by the federal government to give you a pension when you retire. It can also help your family if you die or become disabled.

Employment Insurance (EI)

If you qualify for the EI benefits, know that you only receive a percentage of your last employment pay and only for a limited amount of time.

EI is a federal government insurance plan that can help you financially if you:

- lose your job,

- get sick or injured and your employer does not pay for sick days,

- go on maternity or parental leave, or

- need to care for a very sick or dying relative.

If you have worked enough hours and qualify for the EI program, you will receive some money while looking for a new job, recovering from your illness or injury, raising your child, or caring for your sick or dying relative.

Other Deductions

Some workplaces also have other deductions for things like health plans, pension contributions, union dues, etc. Employers usually pay their employees on the same day of the week every two weeks. You receive your payment in the form of a cheque or by direct deposit into your bank account. Either way, you get a statement. The statement accompanying a pay cheque is commonly called ‘paystub’ or ‘payslip’.

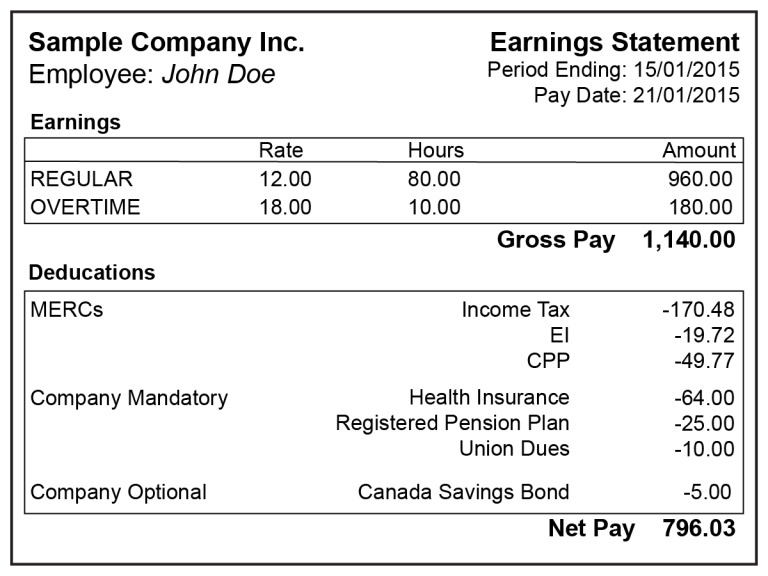

Here is how your pay statement may look like:

It is a good idea to keep your paystubs on file for future reference. You may need them for an EI claim or to file your income tax.

Sometimes you may be asked to show your latest pay stubs as proof of income to qualify for a certain service or loan.

The amounts of Income Tax, CPP, and EI taken off of your paycheque depend on how much money you earn. The more you earn, the more you pay. Also, CRA slightly changes the percentages for mandatory deductions twice a year – in January and July.

The amount of other deductions depends on your place of employment. Sometimes the costs for health plans and pension contributions are shared between the employer and the employee.

Once you retire, CPP might not provide enough money for you to live comfortably. If you can afford it, it is a good idea to save for your retirement by investing in Registered Retirement Savings Plans (RRSPs).